Build a Strong Fundraising Program by Working With Your CFO and Board

Alert! 3 in 10 fundraisers are likely to leave the profession within the next two years. One of the top five reasons talented fundraisers are ready to take their skills to commercial marketing is because their leadership (CEO or board) neither respects nor understands fundraising.

You can read the full survey report from the Association of Fundraising Professionals (AFP) and The Chronicle of Philanthropy here.

While all parties are focused on the long-term sustainability of the organization, tensions can run high between fundraising executives and the CEO, CFO, or Board of Directors, especially when revenue shortfalls begin to accrue.

As an example, we’ve often seen well-meaning Boards of Directors or CFOs cut acquisition programs to save money in the current fiscal year.

But without a continually renewed cohort of annual fund donors to feed an organization’s pipeline, many mid-level, sustaining, major, and planned gifts of tomorrow won’t exist. When this year’s acquisition investment is pared back, overall giving drops off a few years down the road.

The correlation between direct-response marketing and major gifts is clear. Donor data at shows that roughly 80 percent of their individual major donors started out with a gift to a direct-response appeal.

Don’t lose hope! You can build a symbiotic relationship with these key internal stakeholders. Here are 4 ways to get your Board and CFO invested in donor marketing.

1. The best place to start? Education.

Board members are not the typical annual fund or acquisition audience. Fundraising pros often need to educate their boards on who their annual fund donors are, and why the annual fund is important.

On the other hand, if your leadership has for-profit experience (and often many do), it can be beneficial to tap into that experience. Explain donor acquisition in terms that they understand — cost to acquire a donor — just as in business there is a cost to acquire a customer. There is no difference in the nonprofit world.

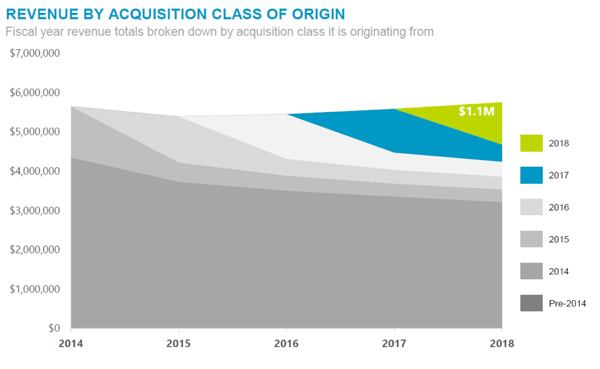

Using a helpful graphic can clarify data when presenting to internal stakeholders. For example, the revenue by acquisition class shows that over 50% of today’s revenue was generated by donors acquired 5+ years ago.

Information like this brings attention to a donor’s lifetime value and can shift the conversation from “how much are we going to save this year” to “how much revenue will be at risk over the next 5 – 10 years.”

2. Set realistic expectations.

During the planning process, review national and sector giving trends with your Board and CFO.

A planning process that sets a goal of 10% growth in giving when the trend in the sector suggests a 5% decline is unrealistic. However, a plan with more conservative goals that can break even or slightly increase giving in the same down market might be an excellent outcome.

Check out our webinar on the latest trends in American philanthropy from Giving USA.

Also, during the reporting phase, showcase the metrics that your leadership and board care most about. While these specific metrics will be different for each charity, here are some that are frequently used: year over year gross revenue, year over year net revenue, actual gross and net revenue compared to budget, number of new donors, number of active and lapsed donors, and donor retention rates.

3. Speak their language.

When reviewing your donor marketing results, it’s imperative to use the same calculations as the CFO (their numbers will likely be the same set the Board uses too). If your Development Department is not the owner of this data, fundraisers might want to request the reports that leadership uses internally, as well as the business rules used to generate those reports. Then, ask specific questions.

- Is the report built by the date a gift is deposited or the date received?

- Does the report run on the nonprofit’s fiscal year or with your mail campaign dates? (End of fiscal year fundraising plays a big impact here!)

- Do you count pledges or only money in the door?

- What are the differences in gift categorizations, like civic, corporate, etc.?

Ultimately, you want all parties to measure success the same way.

4. Build better relationships.

Like all relationships, consistent, clear communication is imperative. You can schedule a monthly meeting with your CFO to discuss gross and net revenue, as well as larger macro level trends and strategies.

Your board deserves frequent updates too. So, discover what interests your Board and then speak to that interest. This is an engaging way to get them to pay attention to your fundraising efforts.

For your nonprofit to be successful, you need to partner with your CFO and Board of Directors. With ongoing education, realistic expectations, shared language, and cultivated relationships, your charity will have a powerful and unified leadership team.