The Predictive Power of the First Gift

Every acquisition analysis begins with the same question: What drives long-term donor value? After examining five years’ worth of performance data, one answer emerged with striking clarity: The first gift amount — not the channel or the creative — is the strongest indicator of a donor’s future potential.

Why the First Gift Matters the Most

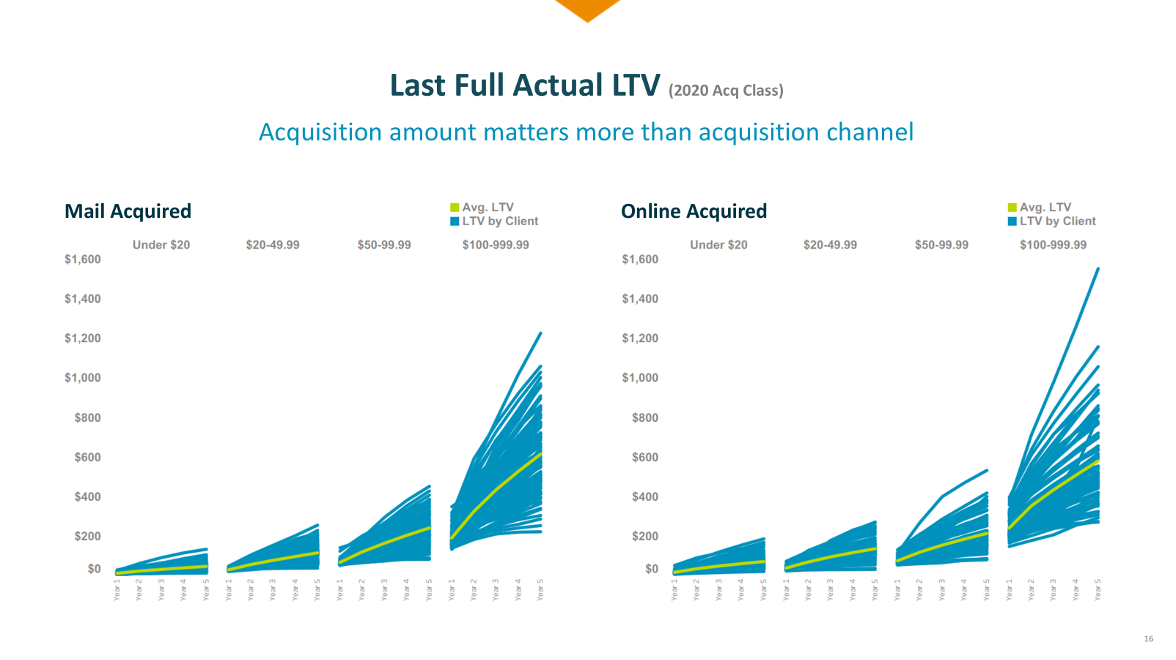

A recent analysis of the 2020 acquisition class examined its five-year Long-Term Value (LTV) performance today in 2025, by acquisition channel and initial gift amount. The results are unambiguous: The donor’s first-gift size is the single strongest predictor of long-term value, far outweighing the effect of the acquisition channel.

Across both mail-acquired and online-acquired donors, the pattern is remarkably consistent. As the initial gift size increases, five-year LTV rises sharply and proportionally. Donors who began with gifts below $20 plateau at modest lifetime returns, while those starting in the $100–$999 range demonstrate exponential value growth over the same period. This steepening trajectory highlights that a donor’s starting commitment establishes their long-term potential more effectively than any subsequent engagement tactic.

Look Beyond Channel

The relative uniformity between mail and online channels reinforces that acquisition method is not the key differentiator. Despite differing solicitation experiences and donor demographics, both channels show nearly identical growth curves within each gift band. Although there are some nuances and data showing that an online donor tends to be acquired at a higher amount, the conclusion is clear: How we acquire donors matters less than whom we acquire and at what level they first give.

Focus on Donor Quality, Not Quantity

This insight carries critical strategic implications. Although traditional upgrade programs remain an essential part of retention and stewardship, the data illustrates that there are natural ceilings to how far we can move a donor up the value curve. A donor who begins at $25 may increase incrementally over time, but their five-year LTV rarely approaches that of a donor who started at $100, regardless of the level of engagement or solicitation frequency. Conversely, donors entering at higher levels tend to sustain, and even accelerate, their value growth, even without aggressive upgrade strategies.

This dynamic should reshape how we think about acquisition investment and segmentation. Rather than chasing volume at the lowest possible cost per donor, we should optimize for quality of entry. We want to attract donors with both the inclination and capacity to give meaningfully from their first interaction. The return on these donors is not only higher, but it’s also more predictable and enduring. This perhaps suggests that in addition to inclination and capacity, first-time $100+ donors are more likely to become more deeply invested in a nonprofit’s mission over time.

From an analytics perspective, this is one of the clearest demonstrations of long-term value predictability we’ve seen. Although there is some variability by client in the five-year growth trajectories for both channels within gift bands, there is strong differentiation between them. The green line, which represents the average LTV for our clients, serves as a reliable benchmark for each acquisition tier, underscoring the consistency of the pattern across clients and campaigns.

Use First-Gift Data to Guide Strategy

Ultimately, this analysis confirms that the first gift is a declaration of intent and capacity, not simply a transaction. It sets the ceiling for future value and should guide our acquisition targeting, creative development, and budget allocation decisions.

In summary:

- The initial gift size is decisive: It’s the primary driver of long-term value and the best predictor of sustained giving.

- The acquisition channel is secondary: Mail and online donors behave similarly when controlling for the first-gift amount.

- Upgrading has natural limits: Although cultivation remains important, the greatest leverage lies in attracting higher-value donors from the outset.

- The strategic focus should shift upstream: Prioritize acquisition strategies that emphasize donor quality over volume.

Our data tells a consistent and compelling story: The path to stronger long-term value begins at the very first gift.