5 Steps to Defeat the Donor Payment Hydra

New payment methods create opportunities and challenges for nonprofits

Sometimes, collecting donations feels like you are battling the mythical Hydra. Figure out one way to accept a donation, and two more appear the next month! We live in a world where technology has increased convenience AND complexity simultaneously.

Donors can choose a dozen different ways to make payments, and new options appear regularly as companies join the transaction-fee gold rush. All these new payment methods are designed (or at least marketed) to increase the ease and convenience of making a transaction. The business logic driving this change is that making it easier to make a transaction increases customer satisfaction … and spending.

But all these new payment methods create complexity for nonprofit organizations that can lead to donor dissatisfaction.

In order to respond to the variety of payment preferences by donors, a nonprofit organization needs to facilitate and monitor giving transactions by cash, personal check, automated bank checks, charitable giving fund distributions, EFT/ACH, offline credit card, online credit card, mobile text, and a growing list of third-party fundraising sources (giving days, Facebook, etc.). Phew!

Not only does the organization have to facilitate and record these transactions, but they also must track each gift back to the donor, fulfill on acknowledgments, and figure out what might have motivated the gift (attribution).

Who Gave What and Why?

Keeping track of a dozen payment methods can make attribution even more difficult. This is a significant challenge because deciding if an event or mailing was worth the cost is critical to making good budgeting choices. What is the next-best dollar spent to meet my goals?

With this growing Hydra of payment methods, it has become increasingly challenging to attribute revenue to a single source of contact with a donor.

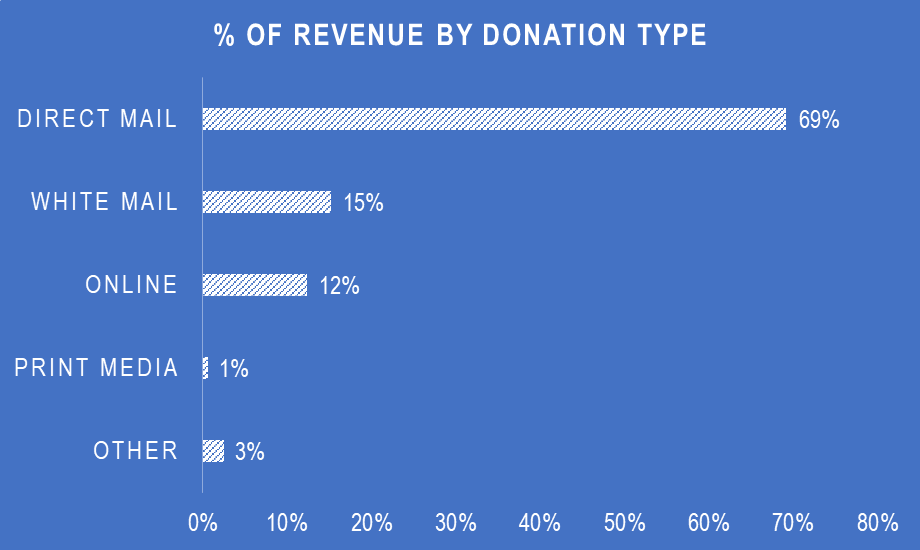

Take for example one client of TrueSense. Out of 57,944 donors who received communication by mail, over 30 percent of revenue came from a different payment source. 8,467 donors (15 percent) made no direct mail remit check donations at all.

This diversification of payment methods has become a significant factor in our planning process. For example, the net cost to acquire a donor might be twice as high in urban areas with high Internet adoption when only counting check revenue, but a match back analysis of online giving by prospects can cut the net cost per donor in half. Suddenly, it didn’t take $100 to acquire that donor, it only cost $68.

In 2018, 26 percent of Bay Area acquisition prospects made an online or offline white mail donation instead of sending a check back.

Third Parties: You Keep the Donation, We Get Your Data

In addition to attribution challenges, the growth of third-party sources for donations (from workplace giving to Facebook) also adds the more significant challenge of attributing a gift back to a specific donor. Limited donor information and a stronger emphasis on donor anonymity promoted by these sources reduces the accuracy of donor information, impacting an organization’s knowledge of their donors.

Opportunity Knocks

While this diversification of payment pathways is a significant challenge, it is also an opportunity. All nonprofit organizations should recognize the opportunity to reduce friction in giving and adapt to the greater range of choices offered to people who want to give. Many of these new payment pathways are favored by a younger and more diverse demographic that organizations often seek. In some cases, the new payment pathways are essential to efficiently managing sustainer giving and providing donors immediate access to their giving information, thus increasing donor satisfaction.

How Do You Kill a Hydra?

Maybe Hercules’ experience can guide us: To defeat the Hydra, Hercules called on his nephew Iolaus for help. As soon as Hercules cut off one head, Iolaus would cauterize the wound with a flaming torch so that nothing could grow to replace it.

Their strategy was to quickly adapt to the challenge and gain control of each step before it got out of hand. In the spirit of Hercules, here are 5 steps to defeat the Payment Hydra:

- Have clear business rules in place for each payment pathway, including how it is used in communication, and the process in place to record accurate and complete giving information in your donor database.

- Carefully weigh the advantages and disadvantages of different payment pathways. How much information will you receive on donors, and how much control will you have over the experience?

- Evaluate the total cost of the payment pathway. Transaction fees up to 5 percent can have an impact on net revenue.

- Have a donor care plan in place to ensure that you can respond to any problems with a payment pathway, especially for recurring giving.

- Have a defined approach to evaluating the value of each contact (both direct and indirect). Any change in communication will have an impact on both metrics.