The Evolving Economics of Direct Mail Acquisition

If you’ve been in the nonprofit space for a while, you might remember the glory days of direct mail acquisition when we all chased that golden 1% response rate and typically saw ~$25 average gifts.

Well … Times have changed.

Today, your organization might be seeing something closer to a 0.4%–0.6% response rate. At first glance, that number can feel discouraging. I’ll be honest: It used to make my stomach flip, too. But that reaction comes from judging new inputs against old expectations. Once you understand why the numbers look different today, the picture becomes a lot more encouraging.

Some of the shift comes from the fundraising environment itself: donor behavior, market saturation, cost structures, and how people respond in a multichannel world. But another important piece is intentional. With smarter tools, the fundraising sector has been able to reduce the “revolving door” of acquiring low-value, one-and-done donors who disappear just as quickly as they arrived.

Today’s direct mail norms reflect a more strategic reality: lower direct attribution response rates, yes — but higher-value donors, with stronger longevity.

Let’s unpack what’s driving this change:

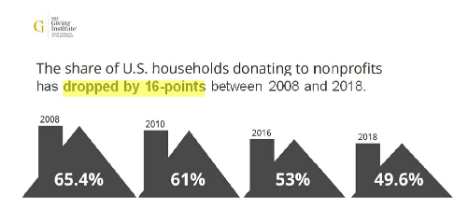

1. Fewer Households Are Giving

This is a well-documented trend across the nonprofit sector. Simply put, fewer U.S. households are donating to charities than they were 10 or 20 years ago.

In 2000, about two-thirds of households gave to charities. Today, that number has dropped below half. This shrinking donor pool means there’s less low-hanging fruit to reach through acquisition.

Source: The Giving Institute

This is discouraging, sure. But what it really points to is a need for more intentionality when deciding where to spend your fundraising dollars. How can we make sure we’re in the hands of the ~50% who do give? Cooperative databases and AI modeling tools help us with this task.

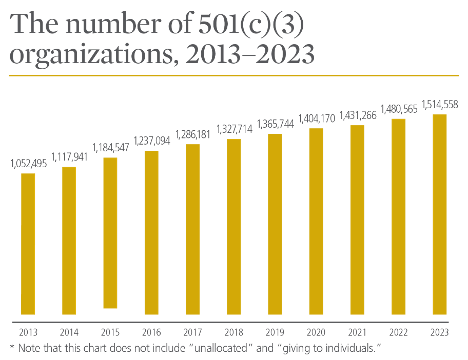

2. Competition for Donor Dollars Has Intensified

There are more nonprofits than ever before. This means more causes are competing for limited donor attention and resources.

Every appeal, every email, every social post is fighting for the same “share of wallet.” That doesn’t mean donors are less generous; it just means there are likely more worthy causes asking them for help.

Source: 2025 Giving USA Report

In a more crowded landscape, the burden is on us to rise above the noise. Competition doesn’t mean that donors care less; it means that our messaging, timing, and overall experience must be more intentional than ever. When generous people have dozens of compelling requests in front of them, the appeals that break through are the ones that clearly articulate why now, why this, and why you. The tighter and more thoughtful our strategy, the more effectively we motivate the right donors to step forward — and stay with us for the long haul.

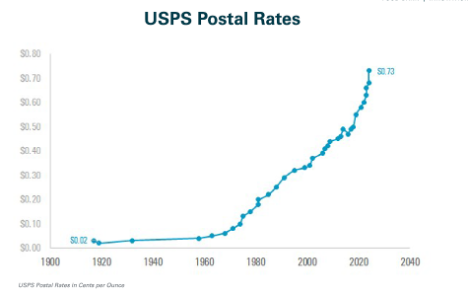

3. Direct Mail Acquisition Strategies Have Shifted Toward Value over Volume

As costs — especially postage expenses — have risen, the economics of direct mail acquisition have shifted dramatically.

Where the cost to acquire (CTA) a donor used to be roughly $40–$50, that figure now often falls between $90–$120. As a result, it has become increasingly difficult for lower-value acquired donors to reach a net-positive return within a reasonable time frame.

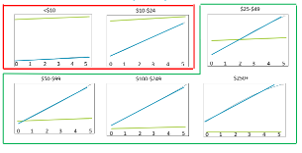

In the charts above, the lime-green line shows the cost to acquire, and the blue line shows the five-year lifetime value (LTV). As you can see, over the course of five years, none of the $0–$24 donors (shown in the charts at the top left surrounded by the red line) produce enough value to cover the initial cost to acquire (they’re net negative for the full five years), whereas those acquired $25+ reach breakeven within 24 months. Generally, the higher the acquisition value, the sooner they recover the expenses associated with acquisition.

To maintain viability and ensure that newly acquired donors can reach breakeven within 24 months, many organizations are adjusting their list strategies and incorporating more value modeling. Instead of pursuing large numbers of $10–$25 donors, they’re focusing on identifying prospects who are likely to give $40, $50, or even $90+ on their first gift.

This intentional shift naturally results in lower response rates, but it also delivers higher average gifts, stronger long-term value, and better retention among direct mail–acquired donors.

4. Expansion of Communication Channels

The reality of influenced giving is that some donors receive a communication in one channel but end up giving in another. This is more prevalent with some nonprofits than others, but the rapid expansion of multichannel communication and fundraising programs means that it will become even more prevalent over time.

The industry is shifting toward more expansion of communication channels and co-targeting opportunities. This includes pairing online media co-targeting and/or email co-targeting with direct mail acquisition efforts, providing surround-sound messaging for potential donors and creating multiple channel opportunities for donations. Although this potentially lowers directly attributable gifts via the mail, it can result in a higher holistic response.

What It All Means

Although the old “1% at $25” benchmark may be behind us, that’s not necessarily a bad thing. Today’s strategies are more data driven, intentional, and sustainable. We’ve shifted our focus from finding sheer volume to strategically cultivating donors who stay engaged and give meaningfully over time.

Lower response rates don’t tell the whole story. What matters more is the value of the donors you’re acquiring and how you continue to build relationships that keep them giving, year after year.

Because at the end of the day, your file size doesn’t pay the bills. It’s about having the net finances to fuel your mission efficiently, responsibly, and with long-term impact in mind.